In fashions, the unbiased variables have to be not or solely barely depending on one another, i.e. that they aren’t correlated. Nonetheless, if such a dependency exists, that is known as Multicollinearity and results in unstable fashions and outcomes which are troublesome to interpret. The variance inflation issue is a decisive metric for recognizing multicollinearity and signifies the extent to which the correlation with different predictors will increase the variance of a regression coefficient. A excessive worth of this metric signifies a excessive correlation of the variable with different unbiased variables within the mannequin.

Within the following article, we glance intimately at multicollinearity and the VIF as a measurement instrument. We additionally present how the VIF might be interpreted and what measures might be taken to cut back it. We additionally evaluate the indicator with different strategies for measuring multicollinearity.

What’s Multicollinearity?

Multicollinearity is a phenomenon that happens in regression evaluation when two or extra variables are strongly correlated with one another so {that a} change in a single variable results in a change within the different variable. In consequence, the event of an unbiased variable might be predicted utterly or no less than partially by one other variable. This complicates the prediction of linear regression to find out the affect of an unbiased variable on the dependent variable.

A distinction might be made between two forms of multicollinearity:

- Excellent Multicollinearity: a variable is an actual linear mixture of one other variable, for instance when two variables measure the identical factor in several items, comparable to weight in kilograms and kilos.

- Excessive Diploma of Multicollinearity: Right here, one variable is strongly, however not utterly, defined by no less than one different variable. For instance, there’s a excessive correlation between an individual’s training and their revenue, however it’s not excellent multicollinearity.

The incidence of multicollinearity in regressions results in severe issues as, for instance, the regression coefficients turn out to be unstable and react very strongly to new information, in order that the general prediction high quality suffers. Varied strategies can be utilized to acknowledge multicollinearity, such because the correlation matrix or the variance inflation issue, which we’ll take a look at in additional element within the subsequent part.

What’s the Variance Inflation Issue (VIF)?

The variance inflation issue (VIF) describes a diagnostic instrument for regression fashions that helps to detect multicollinearity. It signifies the issue by which the variance of a coefficient will increase because of the correlation with different variables. A excessive VIF worth signifies a powerful multicollinearity of the variable with different unbiased variables. This negatively influences the regression coefficient estimate and leads to excessive commonplace errors. It’s due to this fact vital to calculate the VIF in order that multicollinearity is acknowledged at an early stage and countermeasures might be taken. :

[] [VIF = frac{1}{(1 – R^2)}]

Right here (R^2) is the so-called coefficient of dedication of the regression of function (i) towards all different unbiased variables. A excessive (R^2) worth signifies that a big proportion of the variables might be defined by the opposite options, in order that multicollinearity is suspected.

In a regression with the three unbiased variables (X_1), (X_2) and (X_3), for instance, one would prepare a regression with (X_1) because the dependent variable and (X_2) and (X_3) as unbiased variables. With the assistance of this mannequin, (R_{1}^2) might then be calculated and inserted into the components for the VIF. This process would then be repeated for the remaining mixtures of the three unbiased variables.

A typical threshold worth is VIF > 10, which signifies robust multicollinearity. Within the following part, we glance in additional element on the interpretation of the variance inflation issue.

How can completely different Values of the Variance Inflation Issue be interpreted?

After calculating the VIF, you will need to be capable of consider what assertion the worth makes concerning the state of affairs within the mannequin and to have the ability to deduce whether or not measures are obligatory. The values might be interpreted as follows:

- VIF = 1: This worth signifies that there isn’t a multicollinearity between the analyzed variable and the opposite variables. Which means no additional motion is required.

- VIF between 1 and 5: If the worth is within the vary between 1 and 5, then there may be multicollinearity between the variables, however this isn’t massive sufficient to characterize an precise downside. Relatively, the dependency continues to be average sufficient that it may be absorbed by the mannequin itself.

- VIF > 5: In such a case, there may be already a excessive diploma of multicollinearity, which requires intervention in any case. The usual error of the predictor is prone to be considerably extreme, so the regression coefficient could also be unreliable. Consideration ought to be given to combining the correlated predictors into one variable.

- VIF > 10: With such a price, the variable has severe multicollinearity and the regression mannequin could be very prone to be unstable. On this case, consideration ought to be given to eradicating the variable to acquire a extra highly effective mannequin.

Total, a excessive VIF worth signifies that the variable could also be redundant, as it’s extremely correlated with different variables. In such instances, varied measures ought to be taken to cut back multicollinearity.

What measures assist to cut back the VIF?

There are numerous methods to avoid the consequences of multicollinearity and thus additionally cut back the variance inflation issue. The most well-liked measures embrace:

- Eradicating extremely correlated variables: Particularly with a excessive VIF worth, eradicating particular person variables with excessive multicollinearity is an effective instrument. This may enhance the outcomes of the regression, as redundant variables estimate the coefficients extra unstable.

- Principal element evaluation (PCA): The core concept of principal element evaluation is that a number of variables in a knowledge set could measure the identical factor, i.e. be correlated. Which means the varied dimensions might be mixed into fewer so-called principal elements with out compromising the importance of the info set. Peak, for instance, is very correlated with shoe measurement, as tall folks typically have taller footwear and vice versa. Which means the correlated variables are then mixed into uncorrelated major elements, which reduces multicollinearity with out dropping vital data. Nonetheless, that is additionally accompanied by a lack of interpretability, because the principal elements don’t characterize actual traits, however a mixture of various variables.

- Regularization Strategies: Regularization includes varied strategies which are utilized in statistics and machine studying to manage the complexity of a mannequin. It helps to react robustly to new and unseen information and thus allows the generalizability of the mannequin. That is achieved by including a penalty time period to the mannequin’s optimization operate to forestall the mannequin from adapting an excessive amount of to the coaching information. This method reduces the affect of extremely correlated variables and lowers the VIF. On the similar time, nevertheless, the accuracy of the mannequin just isn’t affected.

These strategies can be utilized to successfully cut back the VIF and fight multicollinearity in a regression. This makes the outcomes of the mannequin extra steady and the usual error might be higher managed.

How does the VIF evaluate to different strategies?

The variance inflation issue is a extensively used approach to measure multicollinearity in a knowledge set. Nonetheless, different strategies can supply particular benefits and drawbacks in comparison with the VIF, relying on the appliance.

Correlation Matrix

The correlation matrix is a statistical technique for quantifying and evaluating the relationships between completely different variables in a knowledge set. The pairwise correlations between all mixtures of two variables are proven in a tabular construction. Every cell within the matrix incorporates the so-called correlation coefficient between the 2 variables outlined within the column and the row.

This worth might be between -1 and 1 and gives data on how the 2 variables relate to one another. A constructive worth signifies a constructive correlation, that means that a rise in a single variable results in a rise within the different variable. The precise worth of the correlation coefficient gives data on how strongly the variables transfer about one another. With a destructive correlation coefficient, the variables transfer in reverse instructions, that means that a rise in a single variable results in a lower within the different variable. Lastly, a coefficient of 0 signifies that there isn’t a correlation.

A correlation matrix due to this fact fulfills the aim of presenting the correlations in a knowledge set in a fast and easy-to-understand means and thus types the idea for subsequent steps, comparable to mannequin choice. This makes it attainable, for instance, to acknowledge multicollinearity, which may trigger issues with regression fashions, because the parameters to be discovered are distorted.

In comparison with the VIF, the correlation matrix solely affords a floor evaluation of the correlations between variables. Nonetheless, the most important distinction is that the correlation matrix solely reveals the pairwise comparisons between variables and never the simultaneous results between a number of variables. As well as, the VIF is extra helpful for quantifying precisely how a lot multicollinearity impacts the estimate of the coefficients.

Eigenvalue Decomposition

Eigenvalue decomposition is a technique that builds on the correlation matrix and mathematically helps to determine multicollinearity. Both the correlation matrix or the covariance matrix can be utilized. Typically, small eigenvalues point out a stronger, linear dependency between the variables and are due to this fact an indication of multicollinearity.

In comparison with the VIF, the eigenvalue decomposition affords a deeper mathematical evaluation and may in some instances additionally assist to detect multicollinearity that will have remained hidden by the VIF. Nonetheless, this technique is rather more advanced and troublesome to interpret.

The VIF is an easy and easy-to-understand technique for detecting multicollinearity. In comparison with different strategies, it performs properly as a result of it permits a exact and direct evaluation that’s on the stage of the person variables.

How you can detect Multicollinearity in Python?

Recognizing multicollinearity is an important step in information preprocessing in machine studying to coach a mannequin that’s as significant and strong as attainable. On this part, we due to this fact take a more in-depth take a look at how the VIF might be calculated in Python and the way the correlation matrix is created.

Calculating the Variance Inflation Consider Python

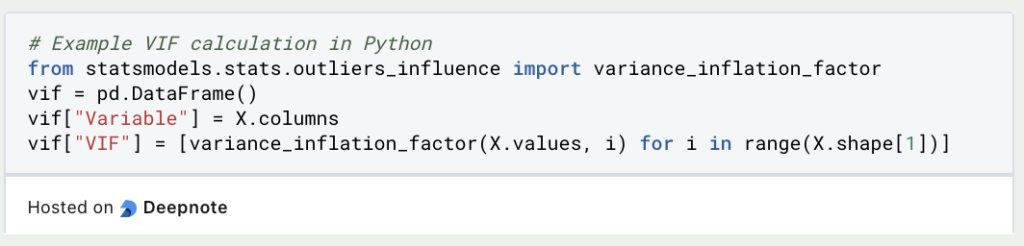

The Variance Inflation Issue might be simply used and imported in Python through the statsmodels library. Assuming we have already got a Pandas DataFrame in a variable X that incorporates the unbiased variables, we will merely create a brand new, empty DataFrame for calculating the VIFs. The variable names and values are then saved on this body.

A brand new row is created for every unbiased variable in X within the Variable column. It’s then iterated via all variables within the information set and the variance inflation issue is calculated for the values of the variables and once more saved in an inventory. This record is then saved as column VIF within the DataFrame.

Calculating the Correlation Matrix

In Python, a correlation matrix might be simply calculated utilizing Pandas after which visualized as a heatmap utilizing Seaborn. For example this, we generate random information utilizing NumPy and retailer it in a DataFrame. As quickly as the info is saved in a DataFrame, the correlation matrix might be created utilizing the corr() operate.

If no parameters are outlined inside the operate, the Pearson coefficient is utilized by default to calculate the correlation matrix. In any other case, you can even outline a special correlation coefficient utilizing the strategy parameter.

Lastly, the heatmap is visualized utilizing seaborn. To do that, the heatmap() operate is known as and the correlation matrix is handed. Amongst different issues, the parameters can be utilized to find out whether or not the labels ought to be added and the colour palette might be specified. The diagram is then displayed with the assistance of matplolib.

That is what you must take with you

- The variance inflation issue is a key indicator for recognizing multicollinearity in a regression mannequin.

- The coefficient of dedication of the unbiased variables is used for the calculation. Not solely the correlation between two variables might be measured, but in addition mixtures of variables.

- Typically, a response ought to be taken if the VIF is bigger than 5, and applicable measures ought to be launched. For instance, the affected variables might be faraway from the info set or the principal element evaluation might be carried out.

- In Python, the VIF might be calculated immediately utilizing statsmodels. To do that, the info have to be saved in a DataFrame. The correlation matrix can be calculated utilizing Seaborn to detect multicollinearity.